How to Trade $100 in Forex: A Simple Guide

Forex trading can be a great way to make money, even with a small amount like $100. Here’s a simple guide to get you started.

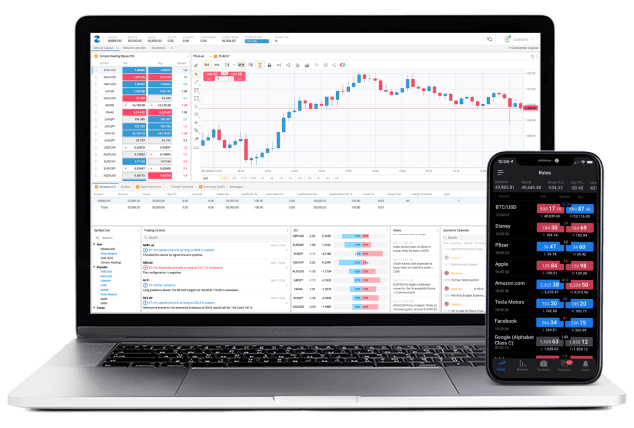

1. Pick a Good Broker

To start trading, you need to choose a forex broker. This is where you’ll open your account. Look for brokers that let you start with a low deposit (like $100) and offer easy-to-use platforms. Also, make sure they have good customer service.

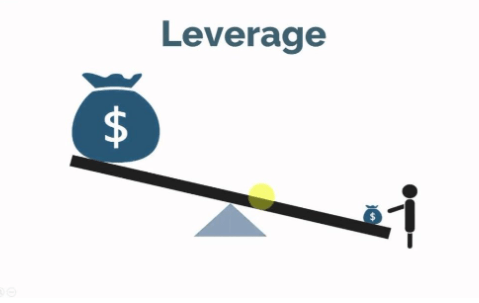

2. Use Leverage Carefully

Leverage lets you trade with more money than you have in your account. For example, if you have $100, and your broker offers 100:1 leverage, you can control $10,000 in trades. But remember, leverage can lead to both bigger profits and bigger losses, so use it carefully.

3. Focus on Low-Risk Trades

With just $100, you need to be careful. Focus on safe, low-risk trades. Don’t try to make big profits quickly. Learn to manage your risk by setting stop-loss orders (which automatically close your trade if the price moves too much against you).

4. Practice with a Demo Account

Before risking your real $100, try trading with a demo account. This is a practice account where you use virtual money to get familiar with the platform and practice your strategy.

5. Control Your Risk

One of the most important rules in trading is to never risk too much on one trade. With $100, you should only risk $1 to $2 per trade. This way, you protect your money and avoid losing it all in one go.

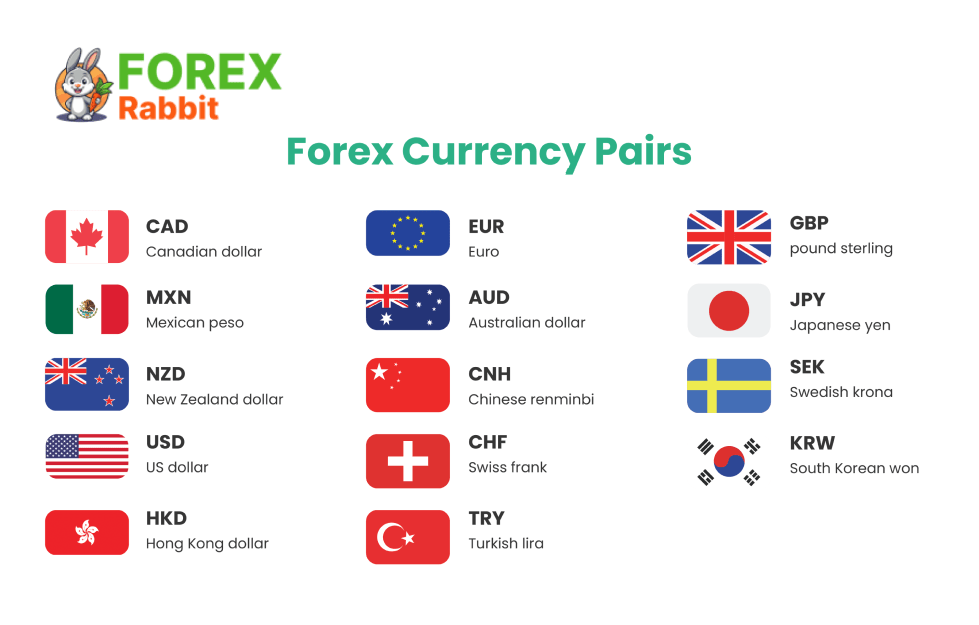

6. Trade Major Currency Pairs

When you’re just starting out, stick to trading the major currency pairs, like EUR/USD or GBP/USD. These pairs are the most popular and tend to have lower spreads, meaning they are less costly to trade.

7. Be Patient and Learn

Forex trading takes time to learn. Don’t rush into trades hoping for quick profits. Keep practicing, and you’ll get better at reading the market and making smart choices.

Share this content:

Post Comment