Introduction

If you’ve ever opened MetaTrader 4 (MT4) or MetaTrader 5 (MT5) and felt overwhelmed by flashing lines, candles, and numbers—you’re not alone. Reading a Forex chart is one of the first skills every trader must master.

In this guide, we’ll walk you through how to read Forex charts step-by-step, identify trends, recognize patterns, and use simple indicators to confirm your decisions. By the end, you’ll be able to interpret charts confidently and even enhance your analysis using MT4 / MT5 indicators or Expert Advisors (EAs)—available free and premium on Payhip.

📊 What Is a Forex Chart?

A Forex chart visually displays currency price movements over time. Each point represents how much one currency is worth compared to another (for example, EUR/USD).

Horizontal axis: shows time (minutes, hours, days).

Vertical axis: shows price.

Each chart helps you understand market direction, volatility, and entry/exit zones.

Why it matters: Every trading decision—buy, sell, or hold—starts with reading a chart correctly.

🧩 The Three Main Types of Forex Charts

1️⃣ Line Chart – Simplicity First

The line chart connects closing prices over time.

✅ Great for spotting general trends.

🚫 Not ideal for detailed price action.

Best for: beginners and long-term trend identification.

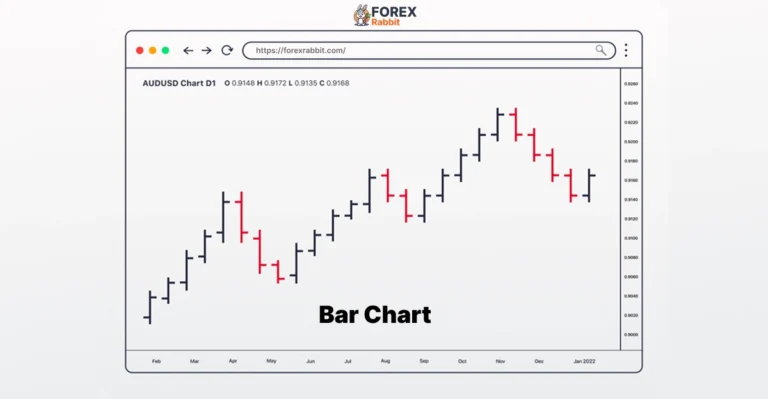

2️⃣ Bar Chart – More Details

Bar charts (also called OHLC charts) show the Open, High, Low, Close prices for each period.

✅ Shows price range and volatility.

🚫 Can look cluttered for beginners.

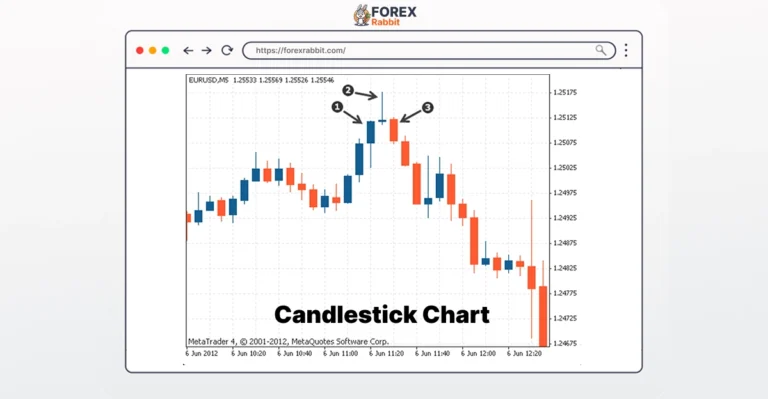

3️⃣ Candlestick Chart – The Trader’s Favorite

Candlestick charts are the most used in Forex trading.

Each “candle” shows the same OHLC data, but in a clearer, color-coded format.

Anatomy of a Candlestick:

Body: the range between open & close.

Wicks (shadows): the highest & lowest prices.

Color: Green = bullish (up); Red = bearish (down).

💡 “A candlestick shows how price moved in a time period—its body shows open and close, and the wicks show highs and lows.”

⏱ Choosing the Right Time-Frame

Different traders use different time-frames:

1 min – 15 min: scalping/day trading.

1 H – 4 H: swing trading.

Daily – Weekly: long-term trading.

Beginners should start with 1-hour or 4-hour charts—these show clear patterns without too much noise.

🔄 Pro Tip: Use multi-time-frame analysis—check a higher chart (daily) for trend direction, then lower charts (1 H) for entries.

🧱 Key Chart Elements Every Beginner Must Know

📈 Trend

Price usually moves in uptrends, downtrends, or sideways ranges.

Draw trendlines along price swings to visualize direction.

💪 Support & Resistance

Support: a price level where demand prevents further fall.

Resistance: a price level where supply stops price rise.

When price breaks these levels, it often signals a trend continuation or reversal.

📐 Chart Patterns

Recognizing shapes helps forecast market moves.

Common ones:

Head & Shoulders – signals reversal.

Double Top/Bottom – trend reversal zone.

Triangles/Flags – continuation setups.

⚙️ Technical Indicators

Indicators confirm what charts suggest.

Moving Averages (MA): smooth out trends.

RSI: measures overbought/oversold levels.

MACD: shows momentum changes.

👉 Try our free MT4 / MT5 Moving Average Indicator here for visual confirmation of trends.

🖥 Step-by-Step: Reading a Live MT4 / MT5 Chart

1️⃣ Open MT4 or MT5 → choose a currency pair (EUR/USD).

2️⃣ Select Chart Type → Candlestick recommended.

3️⃣ Set Time-Frame → 1 H or 4 H.

4️⃣ Add Indicators → e.g., Moving Average, RSI.

5️⃣ Identify Trendlines, Support, Resistance.

6️⃣ Wait for Confirmation. For instance, RSI > 70 = overbought → possible sell signal.

7️⃣ Use EAs for automation → let software scan patterns for you.

🎯 Example:

Price bounces from support + MA cross = strong buy setup.

A free MT4 indicator can alert you automatically (get one at Payhip.com/ForexRabbit).

🤖 Boosting Accuracy with Indicators & Expert Advisors (EAs)

Free Indicators: Great for beginners testing simple strategies.

Paid Indicators / EAs: Advanced automation, multiple signals, back-tested performance.

Our ForexRabbit EA Suite automatically recognizes candlestick patterns and alerts you to high-probability setups.

👉 Download from Payhip →

⚠️ Common Beginner Mistakes

❌ Adding too many indicators (chart overload).

❌ Ignoring higher-time-frame trends.

❌ Trading without confirmation signals.

❌ Blindly trusting EAs without understanding chart context.

Remember: Indicators & EAs support your analysis—they don’t replace it.

📘 Quick Reference Cheat SheetChecklist Before a Trade:

| Chart Type | Best For | What to Look For |

|---|---|---|

| Line | Overall trend | Simplicity |

| Bar | Volatility | Price range |

| Candlestick | Detailed analysis | Patterns & signals |

✅ Check trend direction

✅ Mark support & resistance

✅ Confirm signal with indicator

✅ Set stop-loss & take-profit

❓ FAQs

Q1. What’s the easiest chart for beginners?

A candlestick chart—clear and visual, used by most traders.

Q2. What’s the best time-frame for beginners?

Start with 1-hour or 4-hour charts to reduce noise.

Q3. Can I rely only on indicators?

No. Use them to confirm what the chart already shows.

Q4. MT4 or MT5—which is better for chart reading?

Both are excellent. MT5 has faster execution + more indicators, but MT4 remains beginner-friendly.

✅ Conclusion & Next Steps

You’ve now learned the basics of reading Forex charts—chart types, time-frames, patterns, and indicators.

The next step is practice: open a demo account and start marking trends. When you’re ready, enhance your workflow using our free MT4/MT5 indicator or upgrade to a premium EA for automated chart analysis — all securely available on Payhip.

📥 Download Free Indicator Now → Payhip Store

🎓 Join ForexRabbit Membership for access to premium tools & weekly chart analysis.